The Federal Reserve affects mortgage rates by raising and lowering the federal funds rate. Mortgage interest rates vs.

Interest rate adjustments are subject to a floor rate of 275 and a maximum rate of 500 above the initial rate.

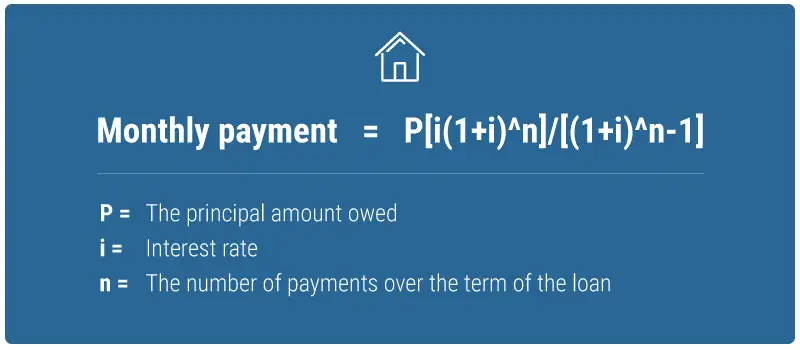

. Thats why a mortgage APR is typically higher than the interest rate and why its such an important number when comparing loan offers. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The number of mortgage applications decreased 40 as reported by Mortgage Bankers Association.

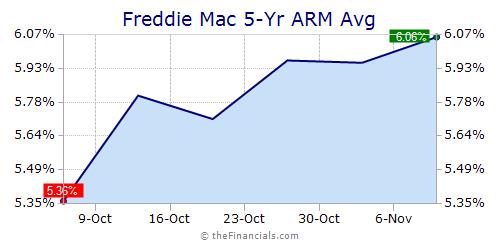

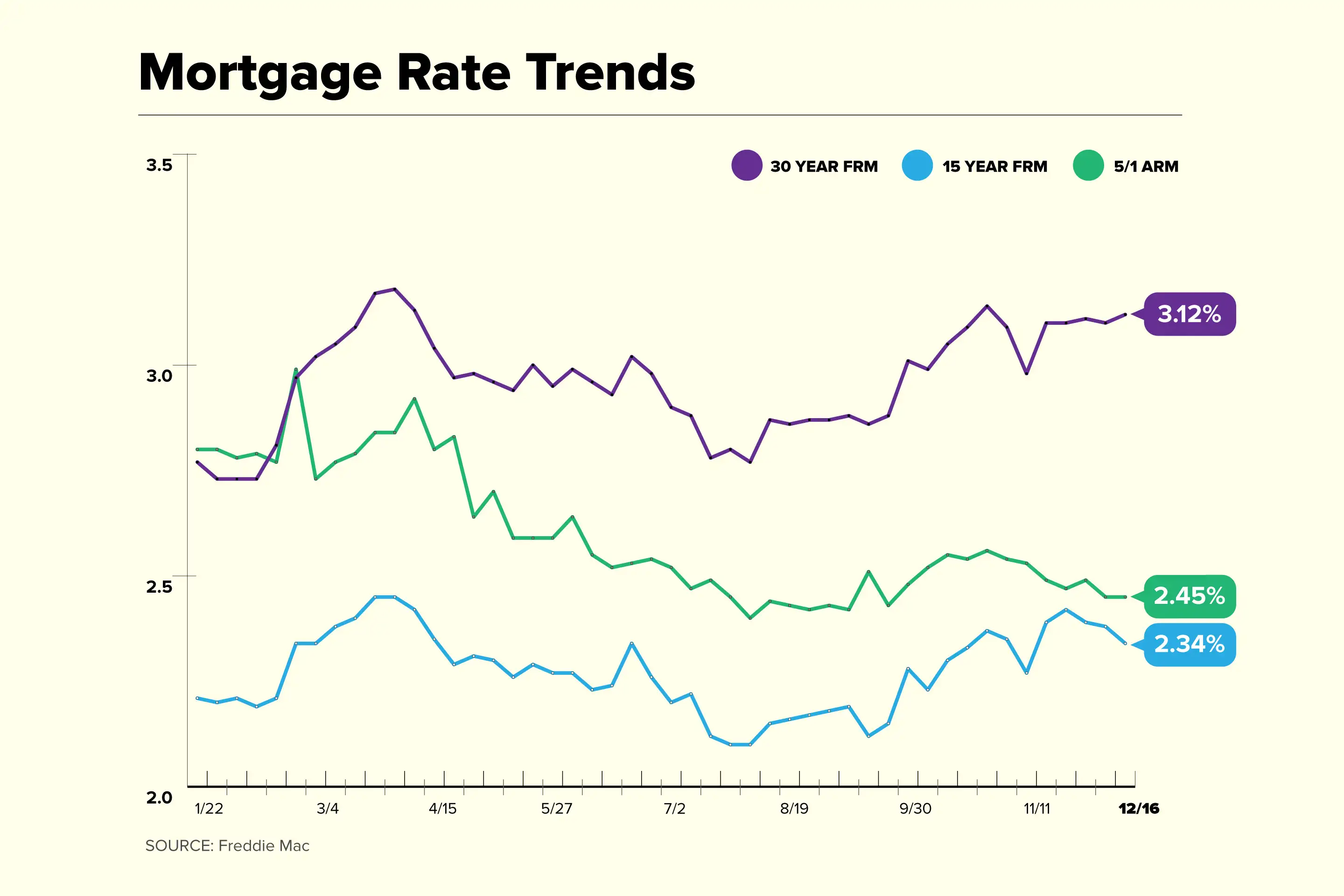

The average mortgage interest rates changed only slightly week over week 30-year fixed rates increased 310 to 312 15-year fixed rates decreased slightly 238 to 234 and 51 ARM rates remained flat 245 to 245. Rate is based on a 45 day lock for purchase transaction. Mortgage interest rates forecast next 90 days.

After the initial fixed-rate period your interest rate can increase or decrease every 6 months according to the then current index. Actual monthly payment will be greater. Check with lenders for details.

Summary of current mortgage rates. Stay connected and informed. 1 Interest rates and payments may increase after consummation.

Emergency actions by the Federal Reserve helped to push mortgage rates below 3 and keep them low. 2 Monthly payments are per 100000 borrowed and do not include additional costs such as taxes and insurance. Mortgage Interest Rates vs.

The consumer does not have to worry about their rates increasing because the interest rate is fixed. There is no federal mortgage rate and mortgage rates dont automatically change when the Fed cuts or. Mortgage loan basics Basic concepts and legal regulation.

For example the consumer obtains a mortgage when interest rates are at their lowest and then interest rates rise. Find and compare 30-year mortgage rates and choose your preferred lender. See todays average mortgage rates and get the best refinance mortgage rates or purchase mortgage rates by comparing mortgage rates for 30 year fixed 15 year fixed 51 ARMs and more.

Mortgage options in Texas. Compare and shop todays mortgage rates from top lenders in your area. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Learn more about APR and interest rates. Loan programs and rates can vary by state. Mortgage News Daily provides the most extensive and accurate coverage of the mortgage interest rate markets.

Also check Texas rates daily before acquiring a loan to ensure youre getting the lowest possible rate. The Annual Percentage Rate APR represents the true yearly cost of your loan. The rates and terms may vary.

Rate information is provided by the lenders members of the Hawaii Association of Mortgage Brokers and the Mortgage Bankers Association of Hawaii and compiled as a public service by the Honolulu Board of REALTORS. When rates are low you can shop in a higher price range. Check rates today to learn more about the latest 30-year mortgage rates.

Mortgage points also referred to as discount points help homebuyers reduce their monthly mortgage payments and interest rates. The lower your interest rate the lower your payment. Interest rates updated as of.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. In the 1970s mortgage. The current rate for a 30-year fixed-rate mortgage is 312 with 06 points paid increasing by 002 percentage points from the previous week.

APR is the interest rate PLUS other fees and costs associated with buying a home so this is. Interest only mortgage rates are commonly 1 higher than 30-year rates. If the interest rates decrease the consumer may have the option of refinancing if the costs of refinancing are less than the overall savings.

Compare the latest rates loans payments and fees for ARM and fixed-rate mortgages. 408 per 1000 borrowed for 360 Monthly Payments. It includes the actual interest you pay to the lender plus any fees or costs.

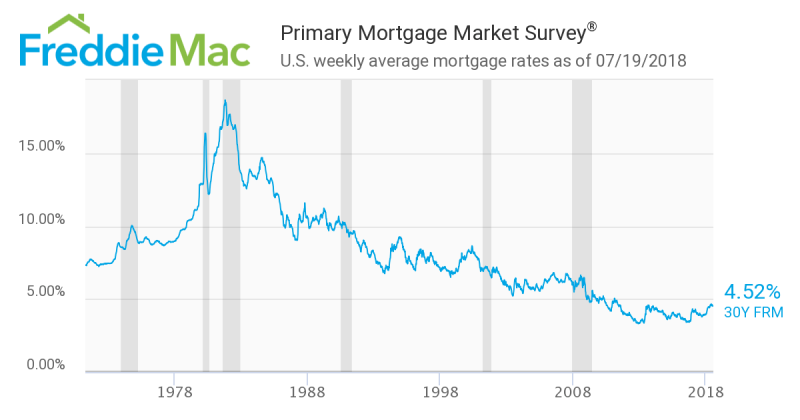

EST and assume borrower has excellent credit including a credit score of 740 or higher. It shows historical rate data back to 1971 for the 30-year along with 15-year data back to 1991 and 51 ARM data from 2005 onward. However we may see rises and falls.

Latest rates based on 20 percent down 200000 owner-occupant mortgages. Mortgage interest rates fell to record lows in 2020 and 2021 during the Covid pandemic. A mortgage point is most often paid before the start of the loan.

Mortgage rates valid as of 02 Dec 2021 0936 am. Interest rates updated as of 12102021. Mortgage rates were mixed again this week with the 30-year rate increasing the 15-year rate decreasing and the 51 ARM remaining unchanged.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for a 5y6m ARM 7 years for a. Mortgage rates move daily. When interest rates are high you get less home for your money.

Weekly Rate Recap Mortgage Rates Today. Economic factors such as inflation unemployment or Federal Reserve monetary policy changes can also influence rates though indirectly. The mortgage interest rate is the interest you will pay on your home loan.

To set yourself up for success and help you figure out how much you can afford get pre-qualified by a licensed Texas lender before you start your home search. Currently a good interest rate will be about 3 to 35 though these rates are historically low. Mortgage interest rates can fluctuate daily even hourly and are influenced by the bond market and trends in the housing market.

Current Fixed Mortgage Rates. With NerdWallets easy-to-use mortgage rate tool you can compare current home loan interest rates whether youre a first-time home buyer looking at 30-year fixed mortgage rates or a longtime. If you already have a mortgage and are.

Currently the federal funds rate is low and the. However keep in mind that these interest rates are an average based on users with high credit scores. The average rate at this.

Average mortgage rates should rise modestly over the next 90 days. 643 per 1000 borrowed for 180 Monthly Payments. The interest rates annual percentage rates APRs and discount points shown are subject to change without notice and may vary based on credit history and market movement.

The average mortgage interest rate is 298 for a 30-year fixed mortgage influenced by the overall economy your credit score and loan type. The following graph shows historical data from the Freddie Mac Primary Mortgage Market Survey. While interest rates and annual percentage rates are related they are not the same but you will see both listed for mortgages.

Mortgage Rates History 1980 2017 National Average Mortgage Rates

Are Mortgage Rates Negotiable How To Haggle Your Way To Big Savings

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Va Mortgage Calculator Calculate Va Loan Payments

Compare Today S Mortgage Rates In Hawaii Smartasset

Refinance Mortgage In Hawaii American Savings Bank Hawaii

Compare Today S Mortgage Rates In Hawaii Smartasset

Interest Rates Over Time Infographic Interest Rates Mortgage Rates Loan Interest Rates

The 30 Year Mortgage Rate And Buyers Hawaii Market Trends Hawaii Life

Average Loan Interest Rates Car Home Student Small Business And Personal Loans Valuepenguin

Mortgage Rate Guide In 2020 By Money Money

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

Conventional Loan Limits For Hawaii Hawaii Real Estate Market Trends Hawaii Life

Current Mortgage Rates Inch Higher Money

The 30 Year Mortgage Rate And Buyers Hawaii Market Trends Hawaii Life

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Best Current Fixed 30 Year Mortgage Rates Refinance Rates Compare Today S Thirty Year Mortgages Interest Rates

0 komentar:

Posting Komentar